Upcoding Risk Heatmaps for Mental Health CPT Bundles: A Visual Compliance Strategy

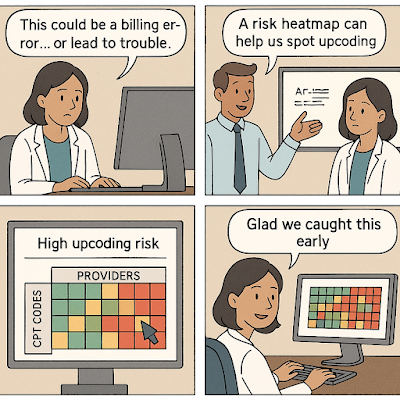

Upcoding Risk Heatmaps for Mental Health CPT Bundles: A Visual Compliance Strategy In the intricate world of mental health billing, accuracy isn't just a virtue—it’s a defense mechanism. One common risk that quietly threatens small practices and enterprise clinics alike? Upcoding. This happens when a provider uses CPT (Current Procedural Terminology) codes that reimburse more than the service that was actually delivered. Sometimes it’s accidental—a busy clinician, a rushed EHR click. Other times, it’s enough to trigger audits, clawbacks, or even regulatory flags. That’s where Upcoding Risk Heatmaps come into play. They’re not sci-fi tech. They’re practical, visual tools for identifying CPT coding anomalies *before* they escalate into compliance nightmares. 📌 Table of Contents Why Upcoding Risk Heatmaps Matter CPT Bundles in Mental Health: A Tangle of Risk How a Heatmap Can Visually Detect Risk Challenges in Deploying These Tools Best Tools to Create a ...